IBPS Bank Probationary Officers(PO)The job of a bank probationary officer (PO) is considered as a lucrative career option and a white collar job. Every year lacs of aspirants contest for Bank PO exams. The job offers a high career growth and prospects for a bright future in banking. Many candidates want to know about the responsibilities of a bank PO, what kind of job they do once they are recruited in banks.

You should know that a bank probationary officer post is the entry level position at which a bank officer starts work after posting. This is a managerial position in a bank. Typically, a Bank Probationary Officer (Bank PO)undergoes a 2 year probation period or training and then gets the post of Assistant Manager on joining a branch. Normal prospect of this job is general banking and bank administration; however, bank POs are expected to possess excellent communication skills and the ability to resolve conflicts in a cool and calm manner.

Starting Salary as a Bank PO ranges from Rs. 30,000 - Rs. 40,000, depending upon bank to bank and location of posting.

IBPS PO Salary Structure 2024

In most of the public sector banks, Bank PO salary is more or less the same. The latest revision of IBPS PO salary as per 10th Bipartite settlement took place on Nov 2012; however, the final agreement was signed in May 2015. According to which the revised IBPS PO salary will come into effect from 1st January 2016.

The revised basic IBPS PO salary structure thus becomes –

23700 - (980 x 7) - 30560 - (1145 x 2) - 32850 - (1310 x 7) – 4202

Here, Rs. 23, 700 is the revised basic pay of Bank PO as applicable on 1st January 2016. Thus the new entrant in a Bank as PO is liable to get Rs. 23,700 as basic pay.

Rs. 980 is the annual increment that an IBPS PO will get and it will be applicable for a period of 7 years.

IBPS PO Salary after 11th Bipartite Settlement

Wage revision for bank employees is due from November 2017 under the 11th bipartite settlement, which would span five years till 2022. Nearly 8.8 lakh employees would benefit if the 11th bipartite settlement is agreed and accepted.

|

Increment (Percentage) %

|

Basic Pay

|

Gross Salary

|

|

15 %

|

Rs.26,706/-

|

Rs.37,068/-

|

|

20 %

|

Rs.27,866/-

|

Rs.38678/-

|

|

25 %

|

Rs.29,026/-

|

Rs.40,288/-

|

|

30 %

|

Rs.30,187/-

|

Rs.41,899/-

|

IBPS PO Allowances

1. Dearness Allowance (DA): In Banks, DA is revised quarterly and is based on the CPI data as revealed by Government of India.The last Revised DA for the quarter of November and December 2015 and January 2016 is 39.80% of the Basic Pay. Since it depends on CPI, DA can go up with higher Inflation and vice versa.

2. Special Allowance: According to IBPS PO's Latest Revision, a special allowance has been added to the salary structure of Bank Probationary Officer. And it is 7.75% of the Basic Pay.

3. House Rent Allowance: This varies according to Bank Probationary Officer’s place of posting and can be 9.0% or 8.0% or 7.0% depending upon metros, big cities and other locations.

4. City Compensatory Allowance: This also depends on the place of posting and can be either 4% or 3 % or 0%.

Hence the total Salary (without HRA) of Probationary Officer becomes Rs. 35,700 – 36,570. While considering the HRA into account, it becomes Rs. 37,360 -38,700.

IBPS PO Perks

1. Leased Accommodation: this facility is available to PO in place of HRA. At some places, banks provide Official Bank Accommodation/Bank Quarter as leased accommodation. This amount is not available as cash component and will directly go to the house owner - you have got leased.

2. Traveling Allowance: Few banks provide fixed Traveling Allowance whereas others allow reimbursement of petrol bills i.e. Bank officer must own scooter/car at the place of posting.

3. Newspaper Reimbursement: A fixed monthly amount is paid towards the cost of one newspaper to the Probationary Officer.

4. Medical Aid: A fixed annual amount is paid by most of the banks (Revised amount is Rs8000/- p.a.).

IBPS PO Promotion

There is a well-defined career progression path in each public sector bank. Performance and potential are key elements which determine the career progression. Most senior officials in public sector banks started their career as a scale-I officer only.

In tune with the time banks have reviewed their promotion policy and now for bright, hardworking and knowledgeable employees, it takes less time to move to higher scales.

In many banks, a person who joined as an IBPS PO may reach to the position of General Manager in 14 years. After that one can aspire for the position of executive director or chairman of a bank. These are very high positions, nomination to which is decided by the Government and not by the individual banks.

Many public sector banks have a network of foreign branches. Thus, joining a public sector bank gives you the opportunity of working abroad also. Transferability in a bank job provides you the chance of seeing different parts of the country. Hence, IBPS PO Promotion is very lucrative.

IBPS PO Career Growth

- Junior Management Grade – Scale I: Officer i.e. PO

- Middle Management Grade – Scale II: Manager

- Middle Management Grade – Scale III: Senior Manager

- Senior Management Grade – Scale IV: Chief Manager

- Senior Management Grade Scale V: Assistant General Manager

- Top Management Grade Scale VI: Deputy General Manager

- Top Management Grade Scale VII: General Manager

- Executive Director (ED)

- Chairman and Managing Director (CMD)

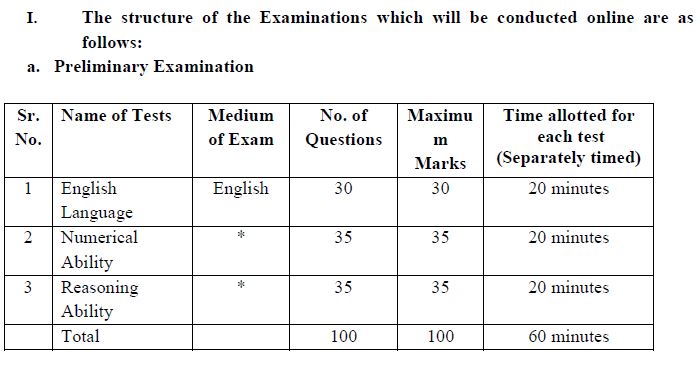

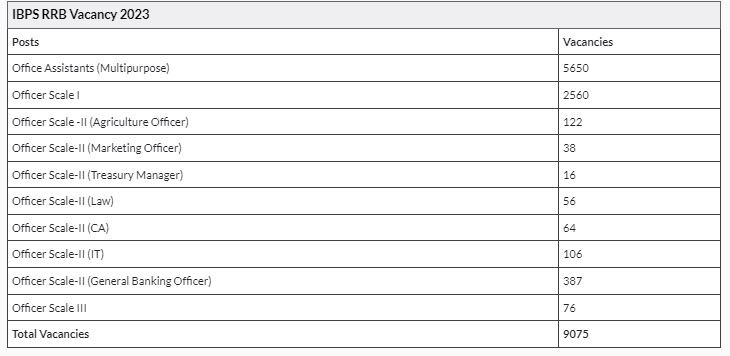

IBPS Bank Clerical - Exam Pattern

IBPS Clerk Job Profile

Candidates once selected as Clerk in various participating banks of IBPS, need to undertake training as well as several routine bank tasks such as:

- Banking Document Verification

- Issue of cash Receipts and ESI Stamps at Counters

- Pass Books Updation of Account Holders

- Manning Single Window Counter task time to time

- Attending to Government Treasury Work

- Collection of receipts, maintenance of ledger, balance tally, etc.

- Sanction of withdrawals, verifying cheques, issuing demand drafts (as per request), etc.

IBPS Clerk Salary 2019

The IBPS Clerk Salary is the sum of the Basic Pay and other allowances.

The initial Basic Pay for IBPS Clerk is Rs 11,765. The IBPS Clerk pay scale is: 11765-655/3-13730-815/3-16175-980/4-20095-1145/7-28110-2120/1-30230/1310-1-31540.

This means the minimum Basic Pay for IBPS Clerk is Rs 11,765 while the maximum is Rs 31540.

Initial Basic Pay – Rs 11765 with a yearly increment of Rs 655 for three years

Basic Pay after 3 years – Rs 13730 and yearly increment of Rs 815 for the next three years

Basic Pay after the next 3 years – Rs 16175 and yearly increment of Rs 980 for the next four years

Basic Pay after the next 4 years – Rs 20095 and yearly increment of Rs 1145 for the next 7 years

Basic Pay after next 7 years – Rs 28110 and yearly increment of Rs 2120 for next one year

Basic Pay after next 1 year – Rs 30230 and yearly increment of Rs 1310 for next one year

Basic Pay after next year – Rs 31540 (maximum Basic Pay)

The different allowances are tabulated below:

|

Special Allowance

|

Initially, the Special Allowance is 7.5 percent of the Basic Pay. After completing one year of service, Special Allowance will be increased by Rs 400 to Rs 500.

|

|

Dearness Allowance (DA)

|

This component is 4 percent of the IBPS Clerk Basic Pay. DA depends on the CPI and is revised quarterly, i.e. after every three months.

|

|

House Rent Allowance (HRA)

|

The HRA depends on the location of the posting. It will be 8.5 percent of the Basic Pay for Metro Cities, 7.5 percent of the Basic Pay for cities having a population of more than 5 lakhs, and 6.5 percent of the Basic Pay for other cities.

|

|

Travel Allowance

|

Expenses on official tours and travels will be reimbursed by the bank.

|

|

Medical Allowance

|

This is paid once a year. For IBPS Clerks, the amount is fixed at Rs 2000.

|

IBPS Clerk Job Profile: IBPS Clerk Roles And Responsibilities

IBPS Clerks are one of the most important posts in the bank they work for. They are the face of the bank as they have to deal with customers on a daily basis. Apart from the decent IBPS Clerk Salary, the job offers great scopes to learn about how a bank functions.

IBPS Clerks are also known as single-window operators as they have to sit at a single window counter and deal with the customers. In every bank, clerks act as the point of contact for the customers. They resolve the queries of the customers, guide them through the various rules and formalities, and solves the various issues faced by the customers.

IBPS Clerks fulfill the roles of a wide variety of posts, working in the various departments of the bank. They work as Loan Clerks, Accounts Clerks, Data Entry Clerks, Office Clerks, etc.

IBPS Clerk Roles And Responsibilities

1. Verification of various documents and proofs submitted by the customers

2. Updating the pass books of account holders

3. Responsible for bank cash, various important documents, keys, etc.

4. Issuing of Demand Drafts (DDs), bank accounts for the customers, cash receipts, etc.

5. Sanctioning of withdrawals by the customers

6. Maintaining the various documents of the bank, balance sheets, ledger, etc.

7. Resolving the various issues of the customers

8. Providing information about the latest schemes and government policies

9. Providing guidance to customers relating to various banking activities

10. Attending to treasury works

11. Resolving queries of the customers

12. Miscellaneous tasks

IBPS Clerk Promotions

As mentioned above, IBPS Clerk offers great chances of growth at both personal and professional level. As you work as a bank clerk and learn the way banks function, you will get ample scopes to prove your potential and merit. Based on your performance and contribution to the organization, you will get a chance to grow. Many top bankers started their career as bank clerks and have slowly climbed up the ladder to higher posts.

IBPS Clerks have to work for a minimum period of 2 years before they can apply for promotions. Hereafter, they will get a chance to get promoted once every two years. Promotions are given the following two processes:

Normal process

Merit based process

Under Normal Process, IBPS Clerks are given promotion based on their experience and seniority. However, they will have to clear the written exam conducted internally. Candidates who get promotion through this process don’t need JAIIB and CAIIB Diploma. The Clerks after clearing the written exam to become Trainee Officer and then bank Probationary Officers (PO).

Under Merit Based Process, candidates must hold JAIIB and CAIIB Diploma from Indian Institute of Banking and Finance.

The subsequent promotions from Probationary Officer are as under:

Assistant Manager – Scale 1

Manager – Scale 2

Senior Manager – Scale 3

Chief Manager – Scale 4

Assistant General Manager – Scale 5

Deputy General Manager – Scale 6

General Manager – Scale 7

IBPS RRB Office Assistant IBPS RRB Salary and Perks for Office Assistant

IBPS RRB Office Assistant Salary

1. Pay Scale of IBPS RRB Office Assistant

IBPS RRB Office Assistant Pay Scale is Rs. 7200-(400/3)-8400-(500/3)-9900-(600/4)-12300-(700/7)-17200-(1300/1)-18500-(800/1)-19300

2. In-Hand Salary of IBPS RRB Office Assistant

The in-hand salary of IBPS RRB Office Assistant varies from Rs. 15,000 – 20,000/-. This salary may vary for different organizations.

We will now have a look at various components of the Salary of IBPS RRB Office Assistant.

Basic Pay

- This is the fixed amount of salary that an employee is eligible for in return for the work he/she does.

Dearness Allowance-

- This is the amount of money that is added to a person’s basic pay or pension because of rising prices and other costs. (This is changed every year taking inflation into consideration).

City Compensation Allowance

- It is the type of allowance offered by institutions to their employees to compensate for the high cost of living in the metro and large cities.

House Rent Allowance-

- It is a component of the salary given by the organization to its employee to meet house rent expenses. (This is a bit low compared to other posts, but it is enough since the banks are located in rural areas.)

- IBPS RRB Office Assistant profile is the starting step of lower management level of RRBs.

- Candidates after selection need to go undergo a training/probation period of 1 year.

IBPS RRB Office Assistant Perks and Allowances

- New recruits under IBPS RRB Office Assistant are entitled to 100% Dearness Allowance.

- Work Pressure in IBPS RRB Office Assistant post is comparatively less as compared to similar posts of other nationalized banks.

- The post of IBPS RRB Office Assistant offers a lot of scope for further career development.

- Working hours are usually fixed for the post of IBPS RRB Office Assistant.

- Home posting is one of the best benefit offered by IBPS RRB Office Assistant post.

IBPS RRB Officers

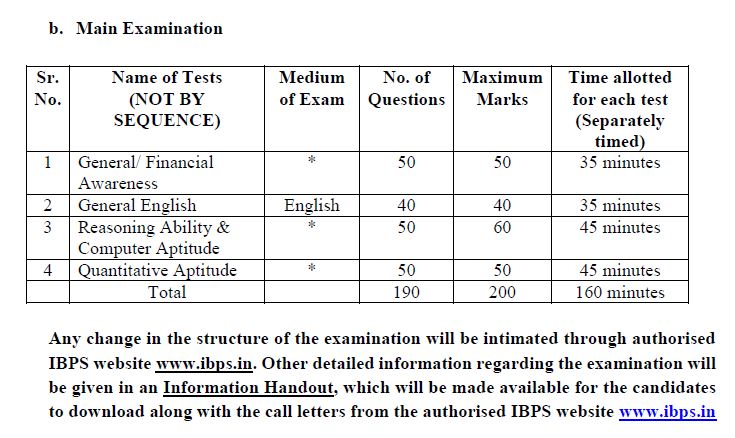

The vacancies for the IBPS RRB recruitment 2024 (CRP RRBs XIII) exam will be announced along with an IBPS RRB 2024 Notification PDF. Last year, IBPS announced 9075 vacancies for the RRB Office Assistant and Officer Scale-I, II & III posts. The table for Post-wise IBPS RRB Vacancy (last year) is mentioned below.

Officers in IBPS RRB draw salaries almost comparable with most of the National banks of the country.

Officers in IBPS RRB draw salaries almost comparable with most of the National banks of the country.- After selection as IBPS RRB Officer Scale I, candidates undergo a training period of 2 years, also called as a Probation period. Under this period, selected candidates receive a fixed amount of salary, which is usually less as compared to the normal salary of IBPS RRB Officer Scale I.

- After successful completion of Probation periods, the candidates are promoted to the post of Assistant Managers in the bank.

- However, this is just the starting salary. Once candidates grow in the organization and move up the hierarchy, the salary also increases.

IBPS RRB Officer Scale I Perks and Allowances

- IBPS RRB Officer Scale I post offers various perks and allowances.

- Work pressure and stress in IBPS RRB Officer Scale I is comparatively less as compared to other commercial banks of the country.

- Employees have a decent work-life balance under IBPS RRB Officer scale I post.

- Also, there is a high possibility of home postings under this post.

- Candidates are eligible for 100% DA.

- Cost of living is usually low in case of IBPS RRB Officer Scale I post since posting is usually in rural areas.

- There are several exchange programs, where the employees of IBPS RRBs are deputed to other government departments for work. Hence, candidates get a chance to showcase their expertise in the work that has been allotted to them.

Specialist Officers (SO)Banks also hire candidates for specialist profiles like – IT Officer, HR Officer, Marketing Officer, Finance Officer, Law Officer, Agriculture Officer etc. Usually, the grade and the starting salary of Specialist Officer is in the same range as Probationary Officers.

SBI PO Job details SBI PO Job Profile

- It is essential to understand what kind of tasks one might have to undertake after getting selected as a probationary officer in SBI.

- The candidates after selection undergo a probation period of 2 years.

- Candidates undergo training in this period to understand the various aspects of banking procedures in a practical way.

SBI PO Salary

One of the most asked questions among students is the in-hand salary that they would receive as a probationary officer in SBI. The basic grade pay is Rs. 27620/- which is accompanied by 4 increments. Apart from this, the salary component involves other Allowances which is as follows. For more details, you can check the SBI PO Salary.

|

SBI PO Basic Pay

|

Rs.27,620/- (with 4 advance increments)

(in the scale of 23700-980/7-30560-1145/2-32850-1310/7-42020)

|

|

Dearness Allowance

|

This is revised every quarter and is calculated based on CPI (Consumer Price Index). Currently, DA is 46.9% of the basic pay.

|

|

City Compensatory Allowance (CCA)

|

This varies with the place of posting at 4% or 3%.

|

|

Leased House Accommodation

|

SBI PO may take a house on lease, the amount of which varies with posting between a minimum of. Rs. 8000/- (in rural areas) and a maximum of Rs. 29500/- (in Mumbai).

|

|

Furniture Allowance

|

Rs. 120000/- for the purchase of furniture

|

|

Medical Insurance

|

100% medical coverage for SBI employees and 75% for their family members

|

|

Travelling Allowance

|

For official travels, reimbursement of AC 2-tier fare is provided

|

|

Petrol

|

50Lts (For 2 wheelers) Or 55Lts (For 4 Wheeler) Or Approx. Rs. 1100-1250 if you don't have 2/4 wheeler (conveyance allowance).

|

Promotion and Career Growth

The career growth of an SBI PO is mentioned below-

- Probationary Officer (Assistant Manager, JMGS - I)

- Deputy Manager (MMGS)

- Manager (MMGS)

- Chief Manager (MMGS)

- Assistant General Manager (SMGS)

- Deputy General Manager (TEGS)

- Chief General Manager (TEGS)

- General Manager (TEGS)

SBI ( clerical) SBI Clerk Job Profile

- The clerk in SBI is a Single Window Operator.

- The work profile of a clerk includes day to day functions such as opening accounts, amount transfers through cheque/ NEFT/ RTGS etc.

- He/she also plays the role of head cashier.

SBI Clerk Salary

- The basic pay of a clerk in SBI is Rs. 13,075.

- The pay scale of a clerk is 11765-655/3-13730-815/3-16175-980/4-20095-1145/7-28110-2120/1-30230-1310/1-31450.

- The clerk in SBI is also eligible for other allowances such as DA, HRA & more

Promotion & Career Growth

- SBI Clerk is a clerical level job.

- To get promoted to an officer cadre, you are required to meet certain requirements at each stage.

- A Clerical cadre gets promoted after a service of 3 years to the post of Trainee Officer.

- Also, an employee can reach to the post of General Manager because of the fast track promotion process of SBI.

Pre-Exam Training

- Pre-exam training is arranged for the SC/ST/XS categories.

- The training is conducted at certain centres by the officials of SBI.

- This training session is conducted for the candidates who are unable to join the coaching centres for their preparation.

- The training session is conducted for 6 days.

- Pre-exam training call letter is released 15 days prior to the examination date.

- Candidates those who have opted for the training will only be eligible to download the call letter